Growing Your Small Commercial Book: Creating the Buying Experience Millennial and Gen Z Business Owners Want

Millennials are the fastest growing segment of small business owners, and a large portion of Gen Zs are also interested in entrepreneurial careers. They have different expectations when it comes to selling and servicing insurance—both an opportunity and a risk for agents.

It’s well known that younger consumers want more on-demand capabilities, but less talked about are what younger business owners want and the impact on agents focused on commercial lines. Next generation business owners present a business growth opportunity, and it’s one that will require agents to evolve their roles as trusted advisors and their use of technology to create a better buying experience.

Get ready for younger buyers: they want more

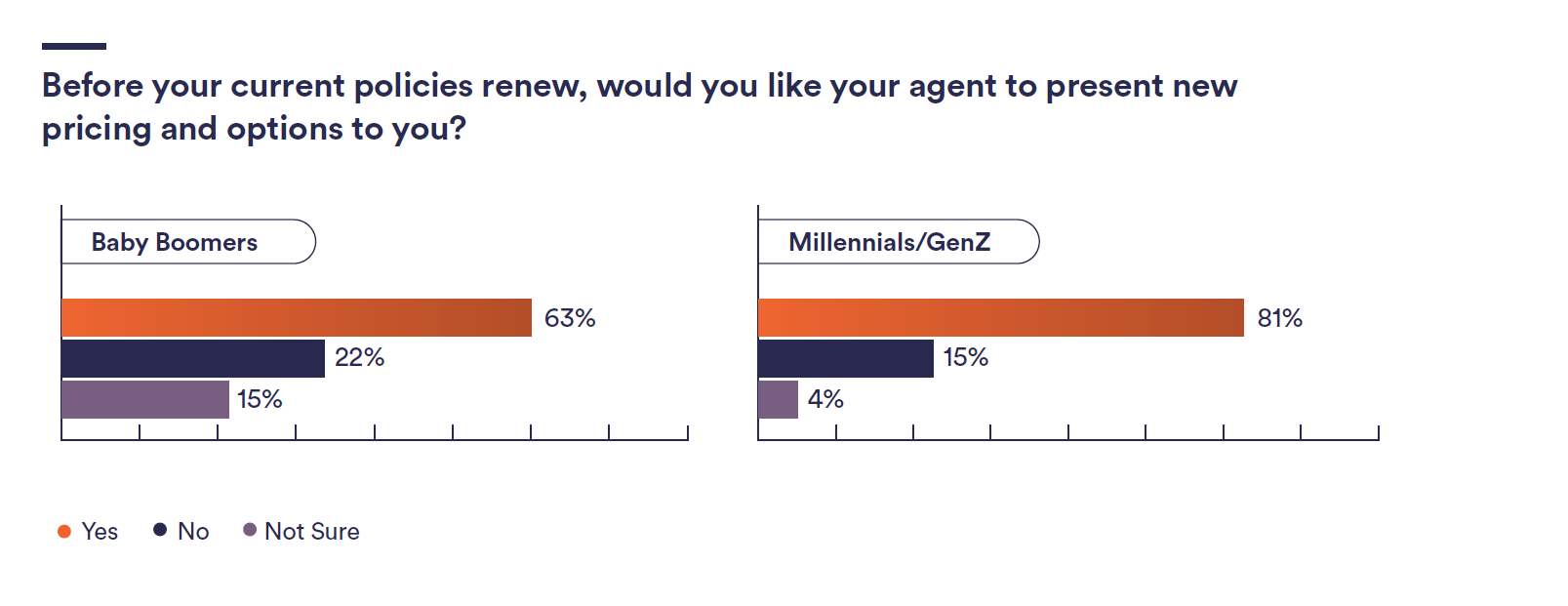

Younger business owners want more advice, more choice, and more communication from their agents, according to Semsee’s Small Business Snapshot. More than 80% of Millennials/Gen Zs want agents to shop coverage before it renews, compared to only 63% of Baby Boomers. Younger business owners also want to connect with their agents more often. While 67% of Baby Boomers are happy with annual communication, Millennials/Gen Zs prefer more frequent communication about risks and coverage options. Nearly one quarter want to review coverage monthly, 24% want quarterly communications, and 29% want to connect with their agents twice a year.

The survey identified an overall insurance knowledge gap among all business owners. Only 26% of Baby Boomers and 21% of Millennials/Gen Zs rated their understanding of their insurance policies as excellent. But when it comes to what’s covered and what’s not, younger owners report even less understanding of insurance and their policies—another opportunity for agents to educate and inform. Fifty percent of Millennials/Gen Zs say they had been surprised to find that something wasn’t covered that they thought was, compared to just 23% of Baby Boomers.

Technology can change the game

How can agents give Millennial and Gen Z business owners the high-touch customer experience they want and still have time to serve their other clients and acquire new business? Here are a few key ways technology can help you provide personalized assistance without adding hours to your workload.

Automated communications

There are a variety of solutions that can help maintain connections with customers. Automated email marketing platforms enable agents to program messages so communications are sent out after a particular action. For example, emails can be automatically sent when a customer’s renewal date is approaching. Or if a prospect submits a request for a quote for a Business Owners Policy (BOP), the system can follow up with a message about BOP FAQs.

Mobile apps & portals

Mobile apps and client portals allow customers to access their policy information whenever and wherever they want. They also enable agencies to utilize communication methods preferred by younger customers. According to live chat company, WhosOn, 61% of customers under 24 admit they avoid calling companies and 60% of millennials prefer live chat to traditional media. Mobile apps and portals often include messaging capabilities so clients have another way to get in touch beyond phone calls and emails.

Quoting

The small business insurance market exists at the point of sale. Quoting solutions can enable agents to submit a single form and receive multiple quotes from carriers in minutes, expediting a process that used to take hours or days when agents had to go to multiple carrier portals. These can also make it easier for agents to compare coverage side by side.

While Baby Boomers may have been comfortable relying on agents to select the best coverage for them, younger customers often want to be part of the decision making. Rather than being sold to, they want to be presented with options. Quoting solutions—like Semsee—lay out all of the options in formats that can be shared with customers via email, appealing to their need to see and compare different coverages.

Integration

Agents should also look for ways to streamline their workflows. A better experience for the agent translates into a better experience for the customer. Solutions that are integrated with the agency management system, such as Semsee with HawkSoft, are designed to deliver a better workflow and agent experience. These solutions that integrate limit the number of screens they need to use, making it easier and faster to do routine tasks, like quoting. The less time spent re-entering information and performing administrative tasks, the more time agents have to meet with customers and advise them on the best ways to protect their businesses.

The power of the trusted advisor

Younger customers expect more value for their dollar. They want agents to advise and help educate them on risks. This is an opportunity for agents to educate and engage by packaging content that can inform business buyers about risks specific to their businesses. For example, creating a checklist of the most common risks for food trucks, or a page reviewing common misconceptions about what BOP policies cover could be very helpful.

Millennial and Gen Z business owners often have done their research before they even talk to an agent. With the agent, they’ll want to dig a level deeper and correct any misinformation, including what is and is not covered in their policies and exactly how the coverage works. Agents should look for ways to make complicated policy language digestible.

To win the business of younger small business owners, agents need to provide an efficient customer experience and offer guidance and advice throughout the customer’s insurance journey. But a high touch experience doesn’t have to mean more work for agents. Using technology can speed up time consuming processes, like quoting, and make it easy to not only provide coverage options but also compare different policies.

By seeking out solutions that integrate with management systems, agents can streamline their workflows, saving them time so they can devote more of their efforts to advising clients. The role of the agent needs to continue to evolve to serve younger customers. Now is the time for agents to adapt and implement the right technologies to meet the needs of the next generation of clients.

This article originally appeared on HawkTalk, a blog from HawkSoft.